January 2026 Newsletter

Licensed Cannabis Properties Heat Up Across Key Markets

Licensed cannabis properties are entering the new year with fresh momentum as operators look for stable, compliant homes for cultivation, manufacturing, and retail. From converted warehouses to greenhouse ready acreage, activity is picking up across several mature and emerging markets.

Owners are upgrading power, security, and layouts to match zoning and licensing requirements, turning underused buildings into turnkey facilities. Sellers and landlords who understand local rules are often first in line when multi state operators and regional brands go shopping for space.

For many groups, control of real estate is now part of the core growth plan. The right property can protect licenses, support expansion, and become a long term cornerstone of enterprise value.

On December 18, 2025, President Trump signed an executive order titled “Increasing Medical Marijuana and Cannabidiol Research,” directing the Attorney General to accelerate the process of reclassifying marijuana from Schedule I to Schedule III.

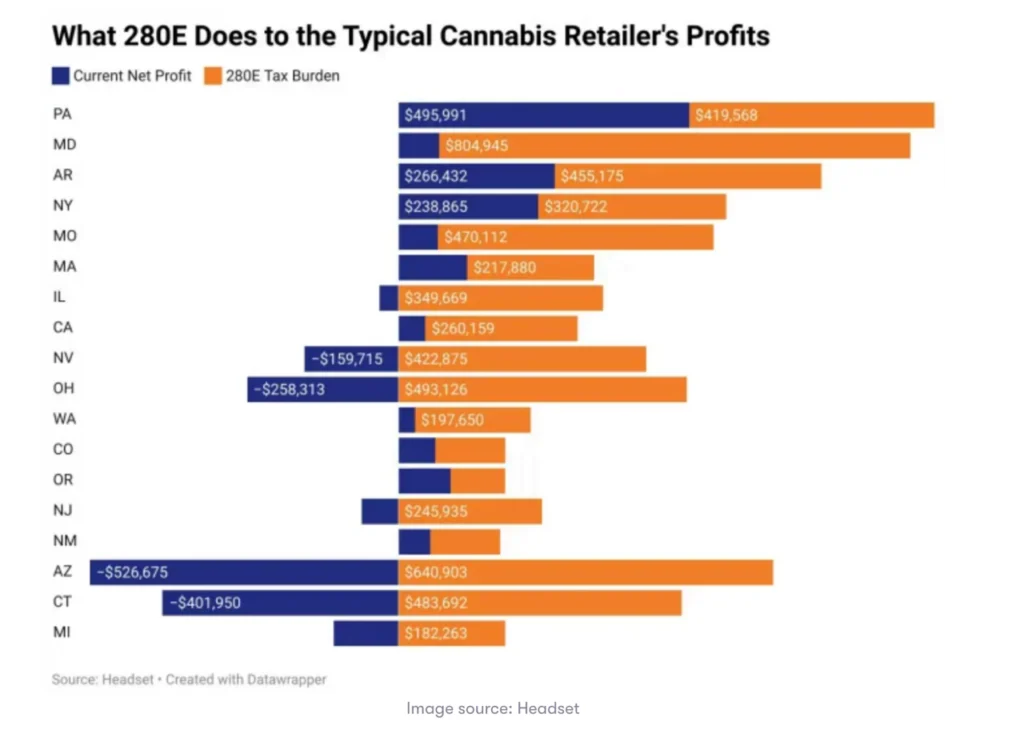

The most immediate and consequential effect of this shift would be the elimination of IRC Section 280E for cannabis operators. A move to Schedule III would permit state-licensed cannabis businesses to take ordinary federal tax deductions—something that has long been prohibited under current law Industry estimates suggest this change could reduce a typical dispensary’s annual tax burden by roughly $268,000. According to Headset data, repealing 280E would free up an estimated $1.6 billion to $2.2 billion in incremental after-tax cash flow each year, capital that could materially improve balance sheets and drive reinvestment across the sector.

The numbers keep pointing to one theme: compliant space is still a growth asset. Flowhub reports the US cannabis industry is projected to reach nearly $47 billion in 2026, with continued growth expected through 2030.

Retail access is now mainstream. 79% of Americans live in a county with at least one dispensary, which drives more site selection, relocations, and demand for well located properties that already meet zoning, security, and compliance requirements.

Shopping behavior is evolving fast. 25% of cannabis sales now happen online, increasing the value of locations that can support fulfillment, order pickup workflows, delivery staging, and efficient back room layouts without triggering expensive rebuilds.

On the macro side, legal cannabis supports an estimated 425,002 full time equivalent jobs. When operators commit to expansion, real estate becomes the stabilizer: the right facility protects the license, reduces operational risk, and supports long term enterprise value.

Source:

Hawaii just put real numbers on the table, and they are hard to ignore. A state commissioned report found that legal adult use cannabis could generate between $46 million and $90 million in monthly sales by year five, even with a capped tax rate of 15 percent. For operators and investors, that kind of demand instantly reframes how valuable licensed real estate could become across the islands.

Tourism fears appear overstated. The analysis shows tourists could contribute at least $11.5 million per month, with most visitors saying legalization would not influence their decision to visit Hawaii at all. In plain terms, cannabis is not a deal breaker for tourism, and in some cases it may even be a quiet tailwind.

To support projected demand, researchers estimate the state would need to license at least 65 dispensaries across the islands. That translates directly into competition for well located, compliant storefronts and mixed use commercial spaces that can meet security, zoning, and buildout standards without friction.

If legalization moves forward, real estate will be one of the earliest pressure points. Groups that secure locations early will control optionality, while property owners who understand licensing pathways could see outsized interest as Hawaii transitions from policy debate to market reality.

Source:

Kentucky is officially moving from policy to storefront reality. A new Lexington dispensary opening marks another step in the program buildout, showing how quickly early market footprints can start to form once licensing clears.

These first locations are setting the template: practical retail, compliant design, and strong visibility without sacrificing privacy. For owners and operators, the best sites are the ones that can clear security, parking, and layout requirements without expensive construction detours.

As more operators come online, product availability and patient traffic typically accelerate, which is when competition for prime locations gets real. Early movers who lock in the right footprint tend to win twice: faster launch and smoother scaling.

Kentucky’s rollout is a reminder that new programs move in phases, but real estate decisions happen now. If you have a compliant retail or light industrial property, you are not early, you are on time.

Source:

Courier Journal photo gallery on Kentucky’s second medical cannabis dispensary opening in Lexington