March 2025 Newsletter

Regulated Cannabis > Intoxicating Hemp? | Big News in CA, NV, and NY | Eric Espinoza is our PRO of the Month

Thank you for being a valued subscriber! This monthly newsletter will bring you relevant industry updates, insights on market trends, and tips to help you maximize CannaMLS for your specific needs. Whether you're looking to buy, sell, or partner, we're here to help streamline your experience. Stay tuned for expert advice and the latest opportunities from across the country!

With Intoxicating Hemp Bans on the Rise, Investors Should Focus on State-Regulated Cannabis Instead

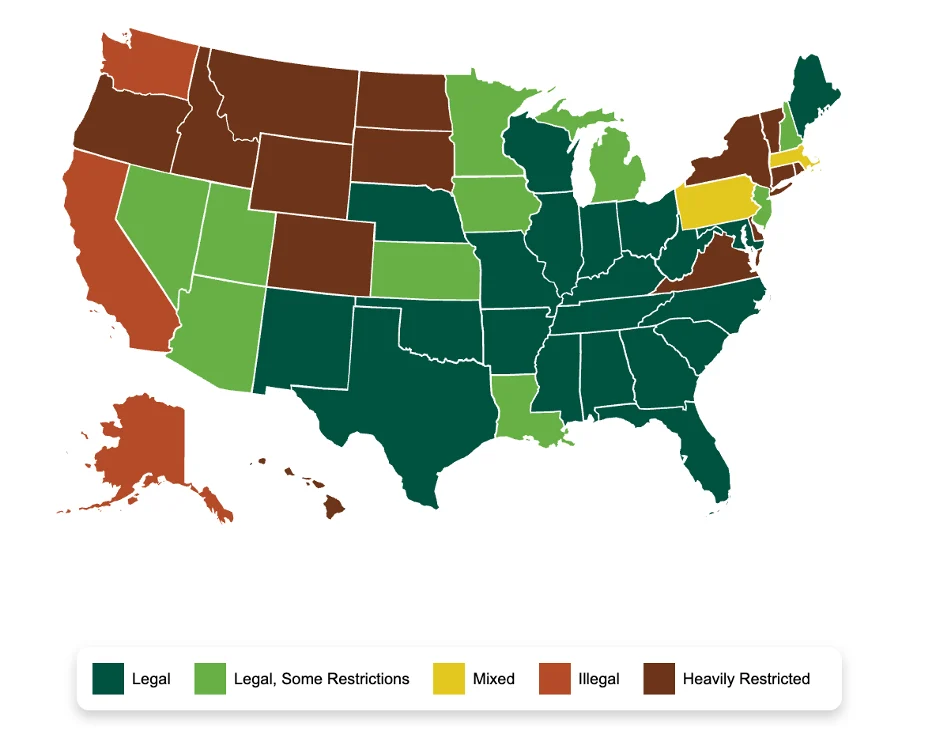

Legal Status of Intoxicating Hemp-Derived Cannabinoids in Each State:

The proliferation of intoxicating hemp-derived products, such as delta-8 THC and THCP, has introduced unregulated and potentially unsafe items into the consumer market. Unlike state-licensed cannabis operators, who must adhere to stringent regulations—including child-resistant packaging, comprehensive testing, and rigorous licensing—producers of these hemp-derived products often bypass such oversight. This regulatory disparity not only poses health risks to consumers but also creates unfair competition for compliant cannabis businesses.

The rapid expansion of the intoxicating hemp industry has significantly encroached upon the market share of regulated dispensaries. Many consumers remain unaware that they are purchasing products not subjected to the same safety and quality standards as those found in state-licensed establishments, leading to potential deception and health hazards. In response, numerous states are implementing measures to regulate or ban these unregulated products. For instance, Ohio's Senate Bill 86 aims to restrict the sale of intoxicating hemp items to licensed dispensaries, thereby ensuring consumer safety and leveling the playing field for compliant operators. Similarly, in New Jersey, the Cannabis Regulatory Commission has initiated a crackdown on intoxicating hemp products, requiring retailers to obtain proper licensing and adhere to the same safety protocols as marijuana products. This move is designed to eliminate unlicensed sales and protect consumers from potentially harmful substances.

At the federal level, legislative efforts are underway to address the challenges posed by intoxicating hemp products. U.S. Senator Ron Wyden introduced the Cannabinoid Safety and Regulation Act, which seeks to direct the Food and Drug Administration (FDA) and the Alcohol and Tobacco Tax and Trade Bureau (TTB) to regulate these products. The proposed legislation aims to establish a federal framework for the oversight of hemp-derived cannabinoids, ensuring product safety and consistency across states.

Additionally, a draft amendment to the Farm Bill, introduced by U.S. Representative Mary Miller, poses significant implications for the hemp industry. This amendment seeks to alter the definition of hemp, potentially restricting the production and sale of hemp-derived cannabinoids. Industry stakeholders express concern that such changes could dismantle the progress made since the 2018 Farm Bill, which legalized hemp cultivation and spurred economic growth in this sector.

Furthermore, attorneys general from 20 states and Washington, D.C., have called on Congress to close the "loophole" created by the 2018 Farm Bill that allows the proliferation of intoxicating hemp products. They advocate for amending the definition of hemp and clarifying states' authority to regulate these products, emphasizing the need for consumer safety and consistent regulation.

These federal and state-level enforcement actions signal a clear trend toward tightening regulations on unregulated cannabis sales, including intoxicating hemp products. For operators and investors, this underscores the importance of focusing on the regulated THC industry for long-term success. Investing in compliant operations not only aligns with evolving legal frameworks but also builds consumer trust and ensures sustainable growth in the cannabis market.

Sources

- Landmark Legislation to Regulate Legal Hemp Products Introduced in U.S. Senate - NCIA

- 21 State AGs Call on Congress to Regulate Intoxicating Hemp Products - Regulatory Oversight

- 21 State Attorneys General Push Congress to Regulate Intoxicating Hemp Products - Marijuana Moment

- Draft Farm Bill Amendment Puts Hemp Industry at Risk - MJBizDaily

- New Jersey Cannabis Regulator Begins Crackdown on Intoxicating Hemp Products - Hemp Today

- Ohio Bill Would Regulate Sale of Intoxicating Hemp Products - Highland County Press

Industry News

The top stories this month from key markets:

The California Cannabis Industry's March 2025 Health Report

- Expansion of Licensed Cannabis Market

- Licensed cannabis production is increasing, and wholesale prices are stabilizing.

- Retail sales volume (units sold) in licensed stores is rising, indicating a shift toward the legal market.

- More local jurisdictions are permitting licensed retail cannabis businesses, improving access for consumers.

- Increased Legal Market Share & Consumer Shifts

- The share of cannabis consumed from the licensed market has grown from 25% in 2019 to 40% in 2024, reducing reliance on the illicit market.

- Enforcement efforts and policy changes have contributed to more consumers purchasing regulated products, ensuring safety and compliance.

- Strong Financial Performance & Equity Initiatives

- The California Cannabis Tax Fund remains stable, with projected revenues of $762 million for FY 2025-26, supporting public services and enforcement.

- Over 2,100 active equity licenses have been issued, fostering social equity participation in the industry.

- Tax policy changes, such as eliminating the cultivation tax, have helped licensed businesses remain competitive.

Nevada's Cannabis Industry Thrives Amid Tourism Boom

- Economic Impact

- Since the legalization of recreational cannabis, Nevada's total sales have exceeded $5 billion, peaking at over $1 billion during the 2021 fiscal year. However, sales declined to approximately $829 million by the fiscal year ending June 2024.

- Tourism's Role

- Las Vegas's status as a major tourist destination significantly influences cannabis sales, with visitors contributing notably to the market. Despite this, specific data distinguishing tourist versus local purchases remains limited.

New York Marijuana Sales Projected to Double to $1.5 Billion in 2025

- Projected Sales Growth

- State regulators anticipate that adult-use marijuana sales could reach $1.5 billion in 2025, effectively doubling the previous year's figures.

- Market Expansion

- The increase in sales is expected to result from the opening of more licensed dispensaries and the maturation of the market.

- Efforts to Curb Illicit Sales

- Ongoing initiatives to crack down on unlicensed cannabis sellers are also contributing to the growth of the legal market.

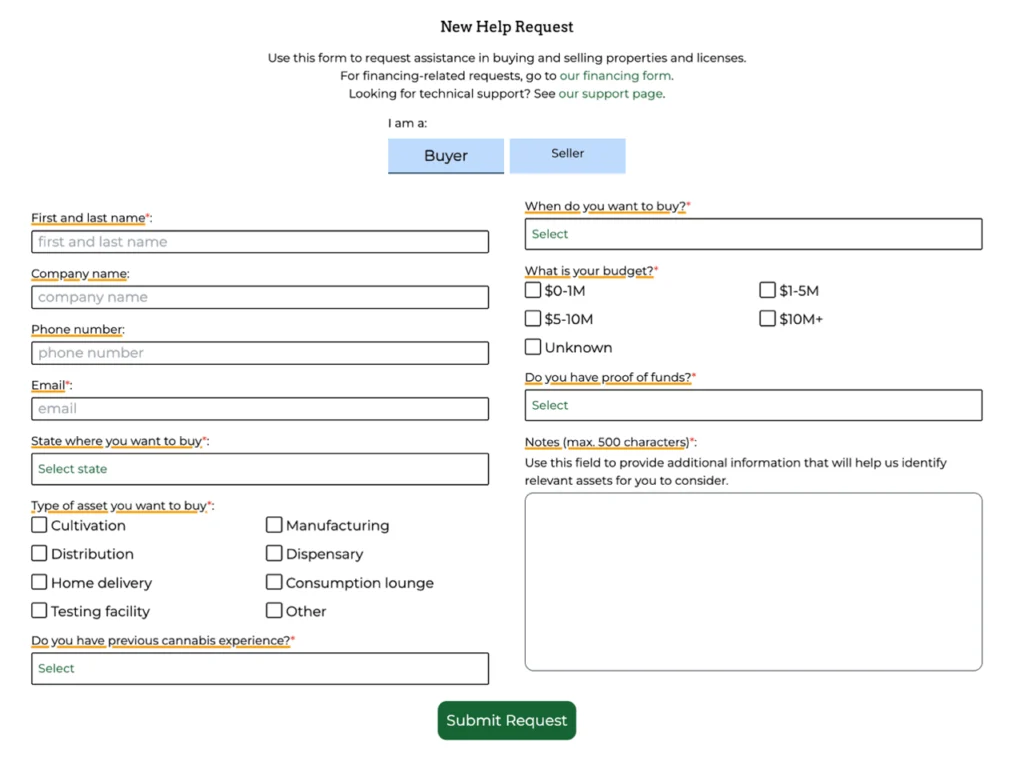

CannaMLS Features to Know

Searching for the ideal cannabis facility anywhere in the U.S.? Let the deals come to you! Fill out a Buyer Help Request, and our network of cannabis PROs will notify you when opportunities matching your criteria hit the market—including exclusive off-market deals. Looking for assets in multiple states? No problem! Submit as many requests as you like and edit them whenever your needs change. Let our PROs help you find your place in the cannabis industry!

CannaMLS PRO of the Month

Q: What trends are you seeing in cannabis real estate pricing for cultivation and dispensary facilities in California?

A: Pricing is starting to stabilize, the average buyer today is starting to look for business with a 2-3X EBITDA or a fraction of the gross revenues. With dispensaries in prime cities holding a higher value, like Fresno & San Diego. While cultivation facilities see price adjustments due to market saturation and shifting demand.

Q: What factors most influence the valuation of cannabis properties in California—location, licenses, or facility buildout?

A: Location is key, followed by the revenues they are generating along with favorable lease terms. Limited-license areas command higher prices, and turnkey fully built out operations add value.

Q: What makes California's cannabis market attractive to out-of-state companies compared to other states?

A: California is the largest cannabis market in the U.S., offering high consumer demand, brand recognition opportunities, and a mature regulatory framework allowing investors, operators to pick up distressed assets at a great price.

Q: What types of properties—cultivation, manufacturing, or dispensaries—are currently in the highest demand in California?

A: Receivership listings are the most in demand, due to the company's prior debts and liabilities being wiped clean for the new operator. Everyone is looking for dispensaries and cultivations, delivery interest has been at an all-time low.

Q: What advantages does an experienced broker bring to the negotiation process?

A: They provide accurate valuations based on recent comps, anticipate landmines, and leverage their experience to ensure a smooth closing for both parties.

Q: What differentiates your approach to selling cannabis facilities from other brokers in California?

A: Our exclusive listings. No one wants to be involved in a daisy chain in order to connect with the decision maker, to go through negotiations, racking up attorney fees for the seller to wake up one morning and decide to no longer sell, wasting everyone's time.

Q: What trends have you noticed in buyer preferences, such as the growing demand for turnkey facilities or clean canvases ready for buildout?

A: Buyers prefer turnkey facilities to avoid lengthy licensing and buildout processes. Especially with all the receivership, distressed, etc listings that are coming online. It makes more sense to acquire a fully built out business vs starting one from scratch.

Q: What types of buyers are you seeing the most demand from in California—operators, investors, or multi-state operators?

A: Existing operators looking to expand, and groups that are new to cannabis are targeting businesses with healthy EBITDAs.

Q: What trends are shaping the future of cannabis M&A?

A: The industry is seeing increased consolidation, with small-mid size companies who waited by the sidelines for the market to go down acquiring smaller businesses to expand their footprint. Additionally, distressed asset sales are becoming more common as some businesses struggle with regulatory challenges and financial pressures. New licensing opportunities and market expansion into emerging states continue to attract investors.

Q: What challenges do sellers face when listing their cannabis business?

A: Sellers often face challenges related to licensing, compliance, and financial transparency. Inaccurate or incomplete financial records can delay and kill deals, and businesses with unresolved legal or regulatory issues may struggle to attract serious buyers.