May 2025 Newsletter

What’s New: CannaMLS Blog Launch. National Association of Realtors Cannabis Real Estate Report. Michael Stratman is our PRO of the Month.

Thank you for being a valued subscriber! This monthly newsletter will bring you relevant industry updates, insights on market trends, and tips to help you maximize CannaMLS for your specific needs. Whether you're looking to buy, sell, or partner, we're here to help streamline your experience. Stay tuned for expert advice and the latest opportunities from across the country!

New Feature Announcement: CannaMLS Blog Launch

We’re excited to introduce a new addition to the CannaMLS platform — the CannaMLS Blog, now live on our homepage. This space will feature all of our newsletters as dedicated blog posts, along with valuable articles covering updates to the CannaMLS platform and insights into the broader cannabis industry. Currently, blog publishing is limited to administrators. However, we’re actively working on expanding this functionality to allow verified users to contribute content as well. If all goes as planned, user-generated posts will be available in the coming weeks. We look forward to seeing the community engage with this new feature and hope you find the content both informative and useful.

Cannabis Industry Spring 2025: Growth and Momentum in Full Bloom

From April through May 2025, the U.S. cannabis industry experienced a wave of forward momentum. Legislative breakthroughs, record-breaking state revenues, product innovation, and federal rescheduling progress have positioned the market for accelerated growth in the second half of the year.

Explosive State Revenue Growth

Illinois cannabis sales have now surpassed $2.1B annually, while Missouri's program is exceeding expectations with over $1.4B in cumulative sales. Maryland crossed the $1B mark in under 12 months of adult-use legalization. New York's licensed dispensaries tripled in number this spring, driving a 300% increase in monthly sales compared to Q1.

Retail and Product Expansion

Major multi-state operators (MSOs) like Trulieve, Verano, and Curaleaf announced Q1 expansions, including over 30 new retail locations and increased investment in edibles and beverage lines. THC-infused seltzers and wellness gummies gained shelf space in traditional convenience stores in compliant states, signaling growing consumer normalization.

Innovation and Investment

AI is transforming grow operations, with companies like Agrify and GroIQ using predictive analytics to increase yields and reduce costs. Meanwhile, the U.S. cannabis capital markets saw their strongest funding month since 2022, with over $620M in new investments driven by optimism around federal reform and market stabilization.

Public Sentiment and Mainstream Support

A new Pew Research poll shows over 75% of Americans now support some form of cannabis legalization. Large retailers and pharmacy chains, anticipating Schedule III rescheduling, have begun exploring distribution partnerships for low-THC or medical-grade products by late 2025.

Sources

National Association of Realtors Cannabis Real Estate Report

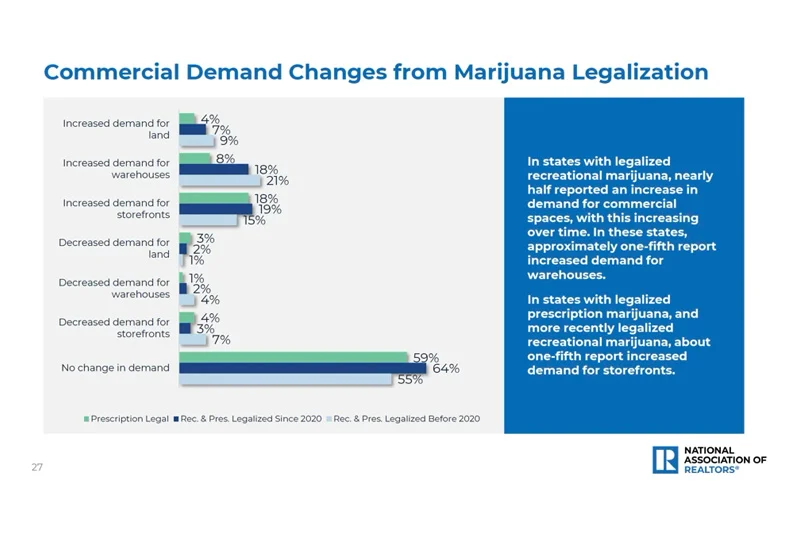

Commercial Real Estate Snapshot from the 2025 NAR Report

Legal cannabis keeps pushing commercial property in a clear upward direction. Fresh survey data from the National Association of REALTORS shows three encouraging shifts for owners and buyers focused on cultivation space, warehouses, and storefronts. Demand keeps climbing. Almost one half of professionals in mature adult-use states now see rising demand for cannabis-ready real estate. Warehouses lead the way, with one in five reporting more requests for power-ready industrial buildings as indoor grows and processing lines expand. Leasing worries remain limited and solvable. Forty-plus percent of landlords in medical markets and one fifth in long-time recreational states report no issues at all with cannabis tenants. Where concerns do arise—odors, fire safety, on-site cash—proven ventilation, sprinkler upgrades, and secure banking partners provide ready fixes. Small owners still steer the market. More than two thirds of landlords leasing to cannabis businesses own fewer than ten properties. This fragmented field gives entrepreneurial investors room to negotiate deals, reposition underused buildings, and assemble regional portfolios before larger institutions scale up.

Industry News

The top stories this month from key markets:

Oklahoma’s Newest Crop: Cannabis Reshapes the Rural Economy

- A Modern Land Rush

- In a detailed May 2025 feature from the Oklahoma Bar Journal, cannabis is being recognized as one of the most significant agricultural commodities to emerge in the state in decades.

- The article draws striking comparisons between the rapid spread of cannabis cultivation and Oklahoma’s historical land rush, positioning the plant as a symbol of new economic opportunity in rural areas.

- Economic Uplift in Rural Communities

- Cannabis cultivation has become a key driver of rural revitalization. Small towns that once faced agricultural decline are now seeing renewed activity, with farmland being repurposed for legal grows and processing operations.

- The influx of cultivators and related businesses has created jobs, boosted local tax bases, and revived demand for industrial services and land leases.

- Navigating Regulatory Terrain

- While early stages of the industry were marred by inconsistent regulations and enforcement gaps, recent improvements to oversight and compliance have stabilized the sector and increased investor confidence.

- The state’s open licensing model continues to attract cultivators from across the country, drawn by low barriers to entry and an established consumer base.

- Outlook for 2025 and Beyond

- Looking ahead, the article suggests that cannabis will remain a staple of Oklahoma’s agricultural landscape. With increasing public support and the possibility of adult-use legalization on the horizon, cultivation is expected to expand further.

- The piece concludes on a high note, framing cannabis not just as a crop, but as a catalyst for rural prosperity and long-term economic diversification in the state.

Washington Cannabis Real Estate: Expansion Fuels a $1.8 B Market

- High-Tech Greenhouse Nears First Harvest

- A new 30,000-sq-ft, climate-controlled facility in Central Washington is set to bring 4,000 premium plants online this summer—evidence of continuing capital investment in cultivation infrastructure.

- Active Deal Flow in Cultivation Properties

- Recent listings include turnkey Tier-2 and Tier-3 farms with automated greenhouses and power-ready warehouses, underscoring steady investor demand for scale-ready assets statewide.

- Retail Footprint Still Growing

- Since March, 17 additional retail locations have cleared licensing, boosting property values in emerging markets from the Tri-Cities corridor to the Olympic Peninsula.

- Robust Tax Revenue Supports Public Services

- FY 2024 cannabis taxes topped $425 million, funding healthcare, education, and local programs—highlighting the sector’s reliability for both investors and state budgets.

- Market Outlook Remains Bright

- Analysts value Washington’s legal cannabis market at $1.8 billion today and project a strong double-digit CAGR through 2030, driven by expanding product lines and steady consumer demand.

Colorado Cannabis Real Estate: Retail Rollouts & Cultivation Expansion

- Colorado Springs Opens for Adult-Use Sales

- Two multi-store chains secured full licenses in April, with seven more outlets queued for approval—unlocking fresh demand for prime storefronts along I-25 and downtown corridors.

- Pueblo County Greenhouse Boom

- Developers are adding more than a million square feet of high-tech canopy this year, cementing southern Colorado as a leading cultivation hub and sparking new land-lease opportunities.

- Denver Warehouse Conversions Accelerate

- Vacant industrial stock in RiNo and Globeville is rapidly being repurposed into vertically integrated “seed-to-sale” campuses, pushing lease rates higher in once-underused submarkets.

- Active Investor Appetite

- A national REIT recently snapped up a Boulder cultivation facility for $42 million, underscoring confidence in Colorado’s mature—but still expanding—cannabis asset class.

- Long-Term Growth Outlook

- Industry analysts project Colorado’s legal cannabis market to climb from roughly $3 billion in 2025 to about $9 billion by 2034, driven by product diversification and tourism-fueled retail demand.

CannaMLS Features to Know

How to Get More Views on Your Cannabis Business Listing

- Use Clear Titles: “Turnkey Dispensary in Tulsa” beats “Great Opportunity.”

- Highlight Your Edge: Use the short description to showcase your strongest selling point.

- Describe in Detail: Include license type, location, equipment, and what makes it a great buy.

- Complete Every Field: More complete listings rank better and appear more credible.

- Add Quality Photos: Upload 3–6 clear, well-lit images, avoid stock photos.

- Choose All Relevant Categories: Match filters like Cultivation or Green-zone confirmed.

- Include Local Info: City, state, and nearby landmarks help with local search visibility.

- Attach PDFs: Brochures or summaries build trust and answer buyer questions.

- Consider a Premium Tier: Silver or Gold listings appear higher and on the homepage for more visibility.

CannaMLS PRO of the Month

Q: How has California’s cannabis real estate market evolved since adult-use legalization in 2016?

After Proposition 64 passed, operators had to custom-build or heavily retrofit sites to meet strict state and local rules. Those capital-intensive build-outs, often financed with debt, squeezed ROI as margins tightened post-COVID. Many borrowers eventually defaulted, returning fully improved assets to lenders or landlords. Well-capitalized buyers can now acquire turnkey facilities at a fraction of replacement cost—often by curing back taxes or lease arrears—gaining hundreds of thousands of dollars in tenant improvements for pennies on the dollar and cutting ramp-up time to market.

Q: What regions in California currently offer the best opportunities for acquisitions, and why?

Opportunity follows oversupply. Los Angeles and Oakland have an excess of retail licenses, while Desert Hot Springs and Humboldt County are saturated with cultivation. Distressed owners in these areas are willing to sell or assign assets at deep discounts, giving cost-conscious operators room to negotiate favorable terms.

Q: How do zoning restrictions affect cannabis cultivation versus retail?

Retail faces caps and tight buffers, limiting storefront supply and supporting higher sales per location. Cultivation is more mobile; growers can ship product from looser zones, absorbing trucking costs much like traditional agriculture. As a result, zoning props up dispensary values far more than it does farm values.

Q: What pricing trends are you seeing for cultivation and dispensary facilities?

Early-stage premiums have faded. As margins normalized, landlords had to concede on rents and sellers on pricing. Overleveraged businesses that paid 2020-era premiums are now a key source of distressed listings.

Q: Greenfield versus turnkey—any pricing gap?

With so many quality facilities on the market, few operators pursue greenfield projects. The lost income during entitlement and construction usually outweighs any theoretical cost savings, so turnkey assets dominate deal flow.

Q: Which factors weigh heaviest in valuation—location, licenses, or build-out?

It depends on the license stack. Retail hinges on foot-traffic and distance to the next dispensary. Cultivation values ride on infrastructure—power, HVAC, and security. Once the shell exists, adding distribution or extraction licenses is relatively easy and adds incremental value.

Q: How will demand for retail and cultivation space evolve over the next few years?

The state already has ample capacity. Growth will come from consolidation rather than new footprints. Expect well-run operators to absorb weaker rivals, concentrating market share without materially expanding square footage.

Q: How does California tourism and brand prestige influence sales?

Tourist hubs see clear summer sales spikes, mirroring Napa’s wine season. If federal legalization arrives, “California-grown” will carry the same cachet as California wine on national shelves, driving wholesale demand for Golden State flower and brands.

Q: What hurdles trip up out-of-state companies entering California?

Fragmentation. No single retailer dominates statewide, so an asset-light model—licensing IP to local partners—lets newcomers scale brand presence without heavy CAPEX. Navigating receiverships and forming local alliances are essential first steps.

Q: Most effective channels for attracting buyers today?

Direct outreach still wins—identifying sub-scale operators on the DCC roster and approaching them before they formally list. Online marketplaces remain invaluable for inbound leads, but proactive networking uncovers the best off-market deals.

Q: Which buyer profiles dominate current demand—operators, investors, or MSOs?

Seasoned operators skilled in distressed acquisitions lead the pack. They excel at curing tax liens or back rent, acquiring stores and farms below market. Institutional investors step in for trophy assets, but full-price deals are rare unless the underlying real estate is truly unique.